Disclaimer: This blog article is for general information only and does not constitute to any legal advice.

Losing a loved one is a difficult and emotional experience. In the midst of grief and sorrow, there are many practical matters that must be addressed, including the distribution of the deceased's assets. Depending on whether your loved one have left behind a will, the process is different. In this article, I will guide you through what do you need to do.

Please note that the information below only applies to non-Muslim. For Muslim inheritance, they will need to follow the Syariah Court.

Since the process is different depending on whether there is a valid will, the most important step is to find out if your loved one had left behind a will. Most people either keep it in their safe or drawer together with other important documents, or they might have stored it at the law firm that drafted their will, or deposited under a commercial custody service.

If you are unsure, your can do a search on the Singapore Wills Registry to see if your loved one have updated the whereabouts of his/her will in the government database. If there is an record, it may help you in locating the original will. However, updating the registry is optional, so even if there is no entry in the database, it does not mean that a will have not been done. It's advisable to physically search their belongings thoroughly before declaring that he/she have passed on without a will.

If he/she does not have a valid will, he/she is considered to have passed on intestate, which you will have to apply for a Letter of Administration. (A Step by Step Guide to Applying for a Letter of Administration)

Conversely, if you have found the original will, you will instead apply for a Grant of Probate. (A Step by Step Guide to Obtaining a Grant of Probate)

Not every asset requires a Letter of Administration (LOA) / Probate to be presented before it can be transferred to the beneficiaries. There are many asset classes that can bypass the probate process. Thus, I always advise my clients to gather this information as soon as possible, before even meeting with me or their lawyers. Often, there are pockets of monies that could be accessible to the family immediately, which could be of immense financial help. You can prioritise settling the assets that do not need the probate to help with the cashflow for the family.

Here are some assets that bypass probate:

For policies that have been nominated, the full death payout will be payable by submitting the death claim form to the insurance company together with the death certificate and other required documents.

Even for policies without nomination, you can claim up to $150,000 (at the sole discretion of the insurance company) as a "proper claimant" without submitting probate. This power is provided via section 61 of the Insurance Act (Cap. 142) in which a proper claimant is defined as the the widower, widow, parent, child, brother, sister, nephew or niece of the deceased. This would be useful for cases where there are no other accessible sources of liquidity, and the family members can use this cash to offset the funeral expenses etc. However, because this may contradict with the content of the will, generally it is better to tap into other sources of money first if possible.

Lastly, also take note that if the insurance policies have critical illness or disability payouts, those would require submitting probate.

CPF monies are not governed by the will. If your loved one made a CPF nomination benefiting you, you will receive a notification from CPF board within 15 working days. You can then log in with your Singpass to withdraw in cash or via GIRO.

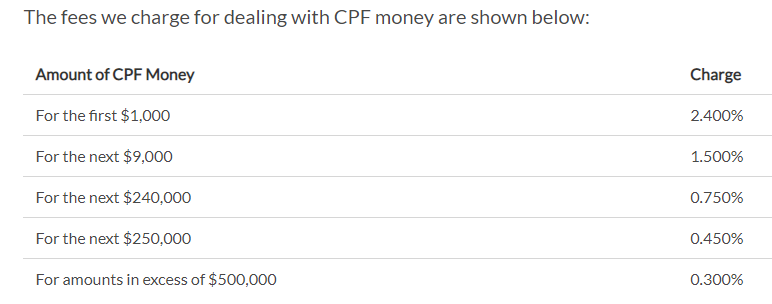

If no nomination was made, you will need to submit a claim to the Public Trustee Office which will distribute it following the Intestate Succession Act. Please note that there are admin fees for this process, hence, it is strongly recommended to do a nomination for your CPF.

Most people own their HDB under Joint Tenancy with their spouse. What this means is that the surviving spouse is entitled to the whole house regardless of the content of a will or otherwise. All you need to do is to update SLA. You can follow the steps from HDB website. Generally this would be the last asset you will settle because HDB will not chase you out of the house. You can spend your time dealing with other assets first and leave this as the last item to handle unless you are planning to sell it soon.

Similar to an HDB under Joint Tenancy, a joint account generally is inherited by the surviving account holder. There are exceptions of course, and sometimes the bank may freeze the account until a probate if submitted.

Most banks have a provision to let the immediate family members to close the account of their loved one if the account balance is very low. All you need is the bank book, death certificate and proof of your relationship (eg: marriage certificate or birth certification). This is at the discretion of the bank, and from my personally experience, usually works for accounts with less than a few thousands dollars.

Whether you are applying for a Letter of Administration or Grant of Probate, you have a choice to attend to it in person or engage a lawyer to act on your behalf. The difference is basically down to cost. If you act in person, you only need to pay the various court and legal fees which usually amount to a few hundred dollars. However, you will need to prepare all the documents on your own, get them commissioned by an oath commissioner, and head to the state court at least 4-5 times. Conversely, if you engage a lawyer, he will sort everything out for you and usually you only need to meet him twice. Cost wise, it varies largely on the lawyer that you engage, as well as the complexity of the case. Generally, prices are around $2,000 - $4,000 on average. If you are not sure, you can get in touch and book a consultation with Chapter 3 to guide you through the process. I work with lawyers, professional trustees and executors to help my clients get through this as pain free as possible.

Update on 18 Apr 2023:

The government have announced a digital initiative to make the process easier for self applicants. This is a blessing for families that doesnt have complex assets. You can do it much easier on your own now.

https://www.straitstimes.com/singapore/application-of-probate-grants-made-more-accessible-with-online-services

If you decide to do on your own, check out our step by step guide to applying for a Letter of Administration or a Grant of Probate!

The Family Justice Courts have a series of very useful information to help Singaporeans to get through this process as smoothly as possible. I have included the link and video here for your reference, hopefully, this will make it easier for you and your family. If you have more questions, please do not hesitate to get in touch.

Info page from SG Courts: https://www.judiciary.gov.sg/family/probate-and-administration

Probate and Administration Toolkit: https://www.judiciary.gov.sg/docs/default-source/family-docs/probate-toolkit---ver-2--nov-2021-(002).pdf?sfvrsn=53e80230_2

Templates for Supporting Documents: https://www.judiciary.gov.sg/family/file-supporting-documents-probate-or-administration

Bernard is a practicing Estate & Succession Planner with 16 years of experience in the financial service industry. He is also a guest lecturer for the Malaysian Law institution for their Diploma in Will Writing and Estate Planning.